Fund scenario analysis for private markets

Relevant to open & closed ended funds

For investment teams

- Secondaries, NAV lending, and Fund of funds: use Puffyn to generate analysis

- Private Credit, Infrastructure, Private Equity: use Puffyn to get ahead of how changes investment performance and timing will translate to fund impact

For fund finance

- Capital call facilities: deciding strategy for usage, comparing lender terms, optimising size

- Fund leverage: fund vs investment level leverage; making more investments

- Liquidity & recycling options: impact on fund performance

Benefits

- Table stakes: Eliminate accuracy issues & key person risk

- Strategic edge: Link every investment decision to its impact on fund performance

Closed-ended fund use cases

Fund formation

- Impact of alternative mgmt. fee calculations

- Impact of limits to fund finance

Investing

- Recycling white space to get alignment

- Impact of leverage (e.g. NAV loan or ABL)

Realising

- Impact of exit delays on fund performance

- Liquidity options

End of life

- Continuation vehicles white space to get

- Secondary sale

Some additional information in one line

Product: Create scenarios, get immediate results

We're moving gross to net fund cash flow modelling out of excel and into a customisable software solution

.png?width=756&height=216&name=Table%20(1).png)

Easily build & run scenarios

Create scenarios to experiment with the impact of credit facilities, exit timing, exit value, etc

Immediate feedback

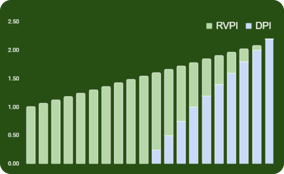

Compare DPI, RVPI, TVPI, J-curve, etc across multiple scenarios